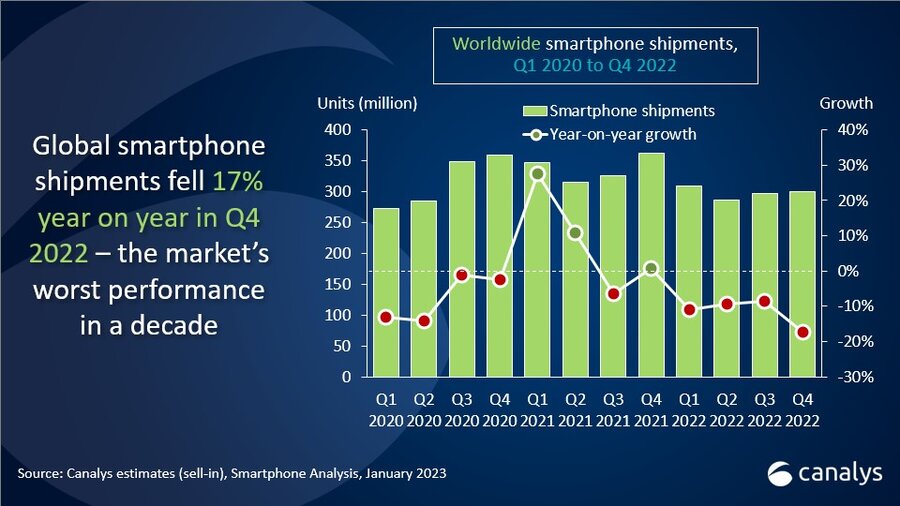

The report states that global smartphone shipment dropped by 17% YoY in Q4 2022 making it the lowest global smartphone shipment in a decade. The full-year decline is said to be 11%. Fewer than 1.2 billion smartphones were shipped worldwide in 2022, Canalys reports.

The negative pattern has remained consistent throughout 2022. Demands for low to mid-range devices fell quickly in previous quarters. Demands for premium phones meanwhile went down, particularly in Q4.

Partly, the low volume of shipments was down to the smartphone OEMs’ highly cautious approach to taking on new inventory. However, what could have been an even worse shipment figure was eased by “strong promotional incentives from vendors and channels as the holiday season helped reduce the inventory levels,” the report says.

Also read: Apple ranked the top smartphone brand globally in Q3, 2022

Global smartphone shipment lowest in a decade – says Canalys

“Smartphone vendors have struggled in a difficult macroeconomic environment throughout 2022. Q4 marks the worst annual and Q4 performance in a decade,” said Canalys Research Analyst Runar Bjørhovde.

The Q4 2022 smartphone shipment shows a stark contrast to how it was in the quarter in 2021. In Q4 2021, global smartphone shipment took on a rising trajectory and eased supply.

Market slump predates 2020 while Covid-19 effects only worsened it for the smartphone industry. The Q4 2022 and the annual figure was the worst in nearly a decade for global smartphone shipment. “We have to go back to 2013 to find lower numbers — and back then the market situation was very different as the technology was a lot more emerging,” Canalys said.

Interest rate hikes, economic slowdowns, and the struggling labor markets are blamed for the regressive smartphone market in 2022.

Check out: Best Smartphones Of 2022 | Budget to Flagship Phones

Apple leads, Samsung at no. 2 in Q4 2022 for global smartphone shipment

Meanwhile, Apple maintained its top stay in Q4 2022 with the highest-ever quarterly market share at 25 percent. Samsung kept its no. 2 spot with a 20 percent market share. However, the South Korean firm stood out for its annual performance in 2022. Book your iPhone 14 Pro Max in Nepal.

Xiaomi stood its ground at third with its market share falling to 11 percent in Q4 2022. OPPO and Vivo grabbed fourth and fifth spots with 10 percent and 8 percent market shares respectively.

| Smartphone brands | Q4 2022 market share |

| Apple | 25% |

| Samsung | 20% |

| Xiaomi | 11% |

| OPPO | 10% |

| Vivo | 8% |

Canalys doesn’t expect restoration for 2023

The market trend is not expected to get out of its abysmal form. Canalys sees a flat to marginal growth for the smartphone industry in 2023 as it sees conditions “remaining tough.” The macro economy will have adverse effects on mid-to-high-end phone markets in Western Europe and North America.

China’s reopening from Covid-19 lockdown could improve domestic markets. But the positive effects will show effects in six to nine months while demand will remain challenging in short term.

Find:

Positivity in Southeast Asia

Despite the smartphone industry seeing another dismal growth in 2023, Southeast Asia could see some positive growth. With the economic recovery in sight and a resurgence of tourism in China, smartphone businesses could see an upward push.

How eager are your to buy a smartphone this year and what particular aspect of a phone pushes you to buy a new handset? You can share your reasons in the comments below.