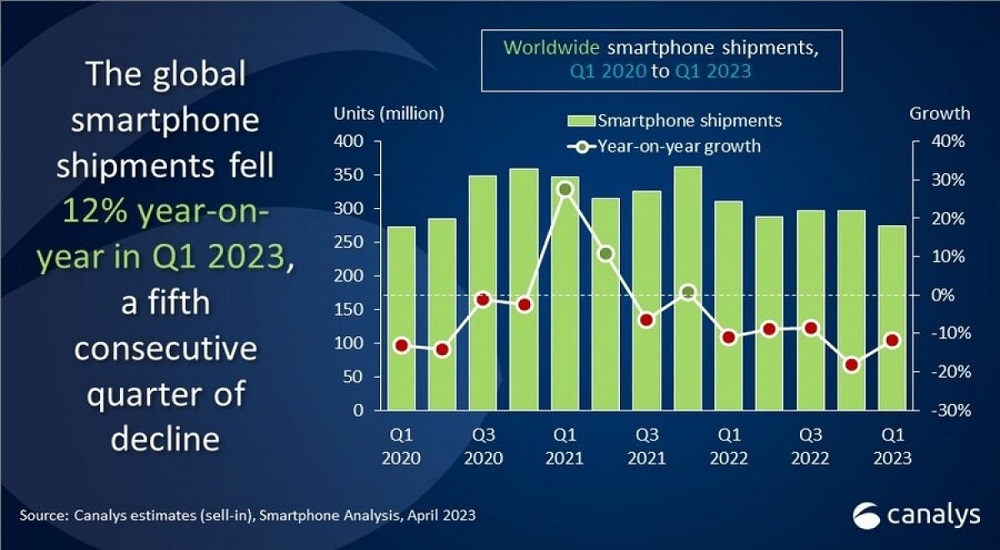

Canalys has published the preliminary report for the global smartphone market for Q1 of 2023 and the early signs are still not bleak for the industry. The latest market share shows the fifth consecutive quarter of decline, this time of 12% year-on-year.

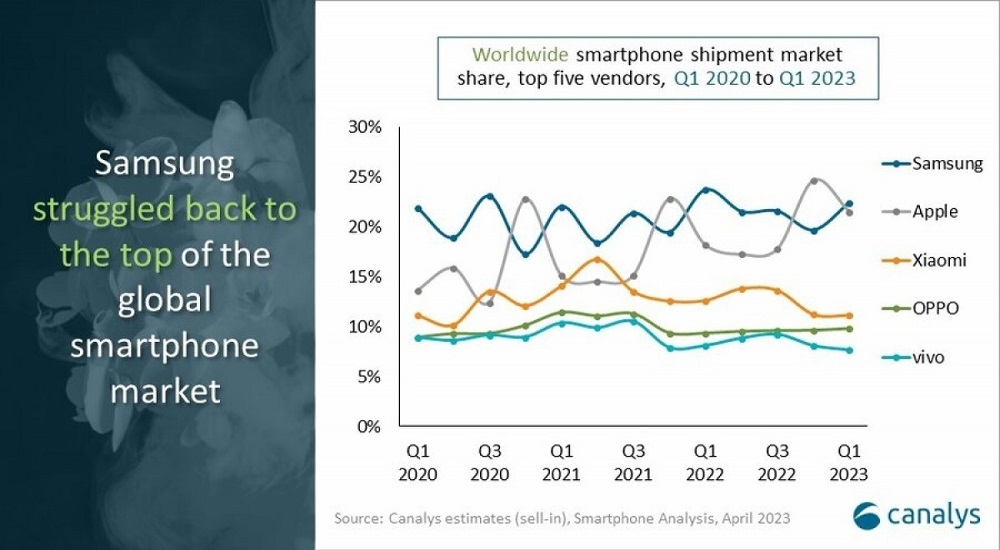

2022 didn’t end on a good note with the report highlighting a fall in global smartphone sales. The start of 2023 couldn’t prove to be brighter as well with most vendors struggling to sell high. Samsung, as the report shows, was the only leading manufacturer to get a quarter-on-quarter recovery and made it to number one with a 22 percent market share.

Likewise, the US phone maker Apple dropped to the second in the rank with 22 percent market share just losing the top perch by a slim margin. Canalys attributes Apple’s strength to a “solid demand for its iPhone 14 Pro series in Q1 2023”. Check out: <<<iPhone 14 Pro Max Price in Nepal>>>, and Apple iPhone Price in Nepal | Latest Update

Chinese smartphone giant Xiaomi kept itself in third position with an 11 percent share. The report says the company’s rank has got its help by its new product launches and continuous inventory adjustment. Other Chinese brands OPPO and vivo came in 4th and 5th with 10 percent and 8 percent market share respectively. Both made strong sales in the Asia Pacific and the domestic markets.

| Smartphone brands | Smartphone market share in Q1 2023 | Smartphone market share in Q1 2022 | |

| Samsung | 22% | 24% | |

| Apple | 21% | 18% | |

| Xiaomi | 11% | 13% | |

| Oppo | 10% | 9% | |

| vivo | 8% | 8% | |

| Others | 28% | 28% |

Check out: Samsung Galaxy S23 Ultra Launched in Nepal | Price and Specs

It was expected

The bleak smartphone market performance was not unaccounted though. “The smartphone market’s decline in the first quarter of 2023 was within expectations throughout the industry,” says Canalys Analyst Sanyam Chaurasia. Related: Global Smartphone Shipment Lowest in a Decade – Canalys

“The local macroeconomic conditions continued to hinder vendors’ investments and operations in several markets. Despite price cuts and heavy promotions from vendors, consumer demand remained sluggish, particularly in the low-end segment due to high inflation affecting consumer confidence and spending.

Additionally, the continuous sluggish end-user demand has triggered a major wave of destocking across the entire supply chain, with channels reducing inventory levels to secure operations. To maintain a low level of sell-in volume, vendors continued to use cautious production techniques, which had a long-term negative impact on the component supply chain’s operational performance,” he added.

At the same time, analyst Toby Zhu says, that there are “signs of moderation in the continued decline”.

“There have been improvements in demand for certain smartphone products and price bands. Furthermore, some smartphone vendors are becoming more active in production planning and ordering components,” he adds.

Check out: Best 5G Phones In Nepal | Midrange to Flagship | 2023

Revival possible in later quarters of 2023

Canalys predicts that the smartphone industry could take a shot at its revival in the coming months. The firm believes that the inventory of the smartphone industry reaches a relatively healthy level by Q2 2023.

However, the recovery is ruled out as it remains too early to predict the status of the overall consumer demand. Anyway, the report claims that the “sell-in volume of the global smartphone market is expected to improve in the next quarters.” Gradually, companies will see a reduction in inventories in the coming months.

5G popularization and foldable phones are also becoming the new driving forces in the industry

Canalys on the revival of the global smartphone market in 2023

In addition, brands have stressed innovations, raising production and channel efficiencies after a round of fluctuations. They are focusing on growing quality over quantity.