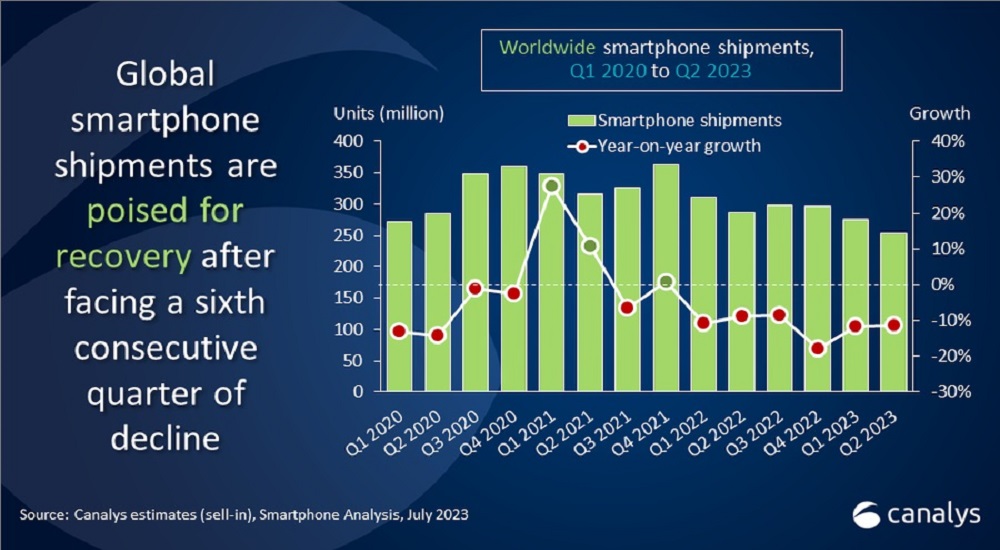

The global smartphone market saw a decline of 11% year-on-year in Q2, 2023 however, there’s still a sign of recovery for the industry after economic recess hit it hardest in the recent successive months, Canalys reports. Improving inventory, increased investment, and growth in order for components are seen as positive indicators for the smartphone shipment revival.

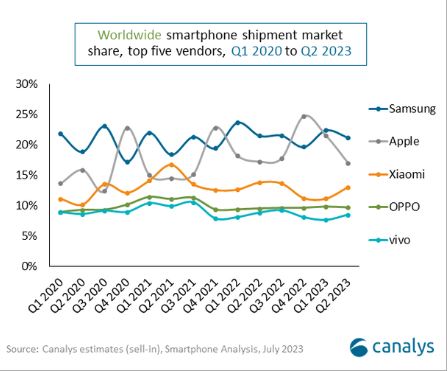

During the second quarter of 2023, Samsung came atop with a 21% market share followed by Apple with 17%. Likewise, Chinese OEM Xiaomi held third place with a 13% market share which Canalys attributes to the positive demand for its newly-launched Redmi series such as the Redmi Note 12 series. OPPO and OnePlus both took fourth place with a 10% market share.

Canalys reports that both these phone makers witnessed a strong performance in the “core markets” of Asia Pacific. Likewise, vivo secured fifth place with an 8% market share which saw its good fortune thanks to the Y-series smartphones. Below, you can look at the side-by-side comparison between the second quarter of both 2023 and 2022.

| Vendors | market share Q2 2023 | market share Q2 2022 |

| Samsung | 21% | 21% |

| Apple | 17% | 17% |

| Xiaomi | 13% | 14% |

| OPPO | 10% | 10% |

| vivo | 8% | 9% |

| Others | 31% | 29% |

The global smartphone market witnessed six consecutive slumps, but Q2 2023 hints at a market revival in Q2 2023

Le Xuan Chiew, an analyst at Canalys says that despite the mixed indicators for the period, the smartphone market is headed for a recovery after months of downturn. “The smartphone market is sending early signals of recovery after six consecutive quarters of decline since 2022,” he said, “Smartphone inventory has begun to clear up as smartphone vendors prioritized cutting inventory of old models to make room for new launches.” He observed that as inventory begins to return to healthier levels macroeconomic conditions are also stabilizing all leading to a possible recovery for global smartphone shipment.

Similarly, Canalys has observed increased investments in channel incentives and “targeted marketing campaigns to stimulate consumer demand” for new smartphones. For instance, Xiaomi, OPPO, vivo, and Transsion are increasing their market share in the sub-$US200 price category with higher sale incentives and retail policies.

Also check out:

- Apple iPhone Price in Nepal | Latest 2024 Update

- Samsung Phones Price in Nepal [Latest 2024 Update] | Specs

- Xiaomi & Redmi Phones Price in Nepal 2024 | Latest Update

Emerging markets key to smartphone revival!

Besides, the research firm also sees other reasons for the gradual market revival. The companies are planning to “hedge key component prices” to fight the possible price hike which has resulted in improved orders in components. Vendors are also investing in manufacturing with a strong market presence in Southeast Asia and India which it sees as a “strong driving force for sustainable growth.”

“Vendors must pay closer attention than ever to significant differences in market conditions as the speed and scale of recovery is highly variable,” remarked Toby Zhu, Analyst at Canalys. “It is vital for smartphone vendors to stay agile to react to new market signals and allocate their resources effectively. Despite being plagued by uncertainties in consumer demand, vendors are still looking for short-term opportunities while trying to maintain their top-level strategy,” continued Zhu. Check out: Best 5G Phones In Nepal | Midrange to Flagship | Latest 2024 update

He added that eyes will be on Android phone makers such as Transsion and HONOR as they are in need to act fast for product “refreshment and also need to use strategic go-to-market tactics to win over consumers. Zhu sees the Middle East, Latin America, and Southeast Asia as vital regions for the two Android OEMs.