E-wallet apps have developed immensely in the digital age, where convenience, speed, and security are fundamental in financial transactions. E-wallets, often known as electronic wallets, have transformed how we manage our funds, make payments, and carry out daily activities. This comprehensive blog will discuss what an e-wallet is and how to create a wallet app.

What do you need to know about e-wallet apps?

What exactly is an e-wallet app?

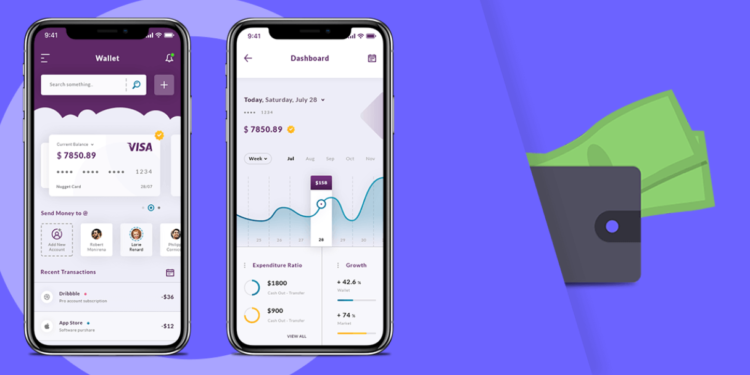

Before understanding how to create an e-wallet app, it is crucial to understand what precisely this wallet is (see the Topflight research). An e-wallet app is a digital repository that allows you to manage payment methods, streamline transactions, and securely link to numerous financial assets. It makes payments, transfers, and financial tracking more accessible and straightforward.

The essential goal of e-wallet apps

E-wallet apps are intended to improve financial transactions’ security, efficiency, and usability. Their primary goal is to replace traditional cash and payment systems with a digital replacement that provides customers convenience and safety. Furthermore, users can keep a permanent record of their transaction history in a digital landscape.

Market cap and analytics of E-wallet apps

Before creating an e-wallet app, let’s discuss its market cap. With the increased acceptance of digital payments, the e-wallet app market has snowballed in recent years. According to Finaria, the industry was expected to expand to $2.4 trillion in 2021, a 24% growth from 2020, and it might reach $3.5 trillion by 2023.

Organizations that depend on digital wallets

Before we discuss how to create a wallet app, let’s first discuss its use cases in the practical world:

E-commerce

E-commerce businesses employ digital wallets for secure online payments, allowing users to store payment information and make rapid, one-click transactions.

Taxi booking apps

Taxi services use digital wallets to streamline passenger payments, reducing dependency on cash and ensuring that trips can be paid for with a few clicks on a mobile device.

Grocery and food delivery

Delivery platforms leverage digital wallets for quick and efficient order payments, increasing customer satisfaction by offering a cashless checkout experience for groceries and food deliveries.

Ticket booking applications

Ticket reservation apps rely on digital wallets for quick and easy transactions covering events, travel, and more, allowing users to buy and pay for tickets on the go.

Mobile wallet apps- Payment methods that come with these applications

To create a digital wallet, you should have a firm grasp of the payment methods that e-wallets utilize:

QR payments

QR (Quick Response) code payments have grown in popularity, allowing consumers to conduct contactless transactions at participating retailers by scanning QR codes. This approach is commonly utilized in retail businesses, restaurants, and even peer-to-peer payments, as it provides a quick and effective manner of transferring money.

NFC

Users can make secure payments using NFC technology by tapping their mobile devices near a suitable payment terminal. It is widely utilized in contactless card payments, transit systems, and various point-of-sale (POS) transactions, making it an attractive option for mobile wallet apps.

Bluetooth

Bluetooth-based payment options are available in some mobile wallet apps, allowing users to conduct transactions by connecting their smartphones to Bluetooth-enabled devices such as in-car payment systems or wearable gadgets. This strategy improves the ease and flexibility of mobile users.

Cryptocurrency

Many mobile wallet apps now support cryptocurrencies such as Bitcoin and Ethereum. Users can utilize the wallet to store, send, and receive cryptocurrencies, making it a safe and effective way to manage digital assets.

How to create a wallet app- Understanding the architecture

To build your own e-wallet app, the following are the essential components on the user panel side of the app:

User Panel

The User Panel is the application’s front end, where users interact with it. It comprises user interface (UI) elements like buttons, forms, and menus that let users access the app’s core functionality.

Registration

User onboarding is the first step in creating an account within the wallet app. Upon registration, users create an account by providing personal information such as their name, email address, and phone number.

Bank account authorization

Users must go through a verification process to link their wallet app to their bank accounts. This step involves providing their bank account information, subsequently validated for enhanced security and utility.

Cash Transfer

The ability to transfer money is one of the most essential features of a wallet app. Users can send money to other app users or outside bank accounts. User authentication and encryption are critical security procedures for secure money transfers.

Checking balance

Users must have access to their account balance at all times. This feature enables them to keep track of their financial situation and make educated financial choices.

Transaction history

Transaction history space shows users a complete record of their previous transactions, including the date, recipient, and transaction amount. This transparency promotes confidence and lets people track their financial transactions.

Administrator Panel

The administrator panel is the foundational element to building a mobile wallet app, which is necessary for managing and overseeing the app’s activities. The following are the main components of the Administrator Panel:

Dashboard

The Dashboard gives admins an overview of the app’s performance and key metrics at a glance. It provides real-time data such as the number of users, transaction volumes, and other vital statistics, letting administrators keep track of the app’s health and activity.

Offers

Administrators can use this functionality to design and administer special promotions, discounts, and loyalty programs within the app. It is critical for engaging and maintaining people and increasing transactions and revenue.

Reporting and analytics

Reporting and analytics solutions provide information about app usage, transaction trends, and user behavior. Administrators can generate reports and gain access to data-driven insights to help them make informed decisions and improve the app’s performance.

Adding/blocking features

Administrators have the authority to add new features or disable particular app functions. They can customize the user experience, make upgrades, and control security by blocking or unblocking specific functionalities as needed.

Conclusion

In conclusion, e-wallet apps make managing your money simple and secure. When you understand how they work, you can develop your own app that is straightforward to use for everyone. We sincerely hope that our guide on how to create a wallet app answers all of your queries regarding e-wallets.