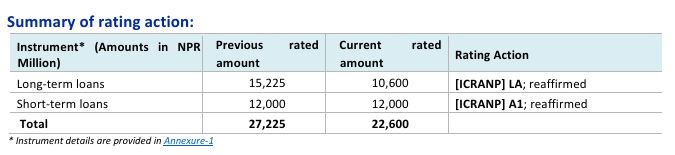

Private telecom operator Ncell has been awarded with “A” rating by ICRA Nepal for a loan of Rs 22.60 billion. The rating hints at the company’s strong financial position despite seeing falling revenues in recent years.

The company received its rating for a long-term loan of Rs 10.60 billion and a short-term loan of Rs 12 billion. In which, the telco obtained the rating of ICRANP LA for long-term and ICRA NP A1 for short-term loans. The credit rating agency released these ratings on December 31.

Last year, the Ncell had its rating assessed for a loan of Rs 27.22 billion. The ratings have been reaffirmed this year.

Out of the Rs 12 billion, 4 billion has been allocated for fund-based limits i.e. working capital loans. Likewise, the remaining 8 billion is kept under non-fund-based limited i.e. letters of credit.

Out of the Rs 12 billion short-term loan, Rs 4 billion has been allocated for fund-based limit or working capital loans. Similarly, the Rs 8 billion has been separated under Non-fund-based limits or Letters of credit.

DID YOU KNOW: Ncell provides unlimited night data for Sadhain ON subscribers

The rationale for Ncell receiving an “A” rating for a long and short-term loan

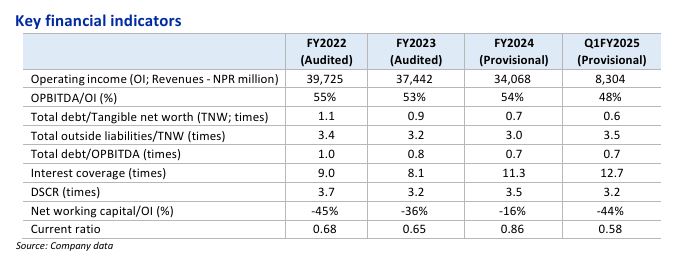

The agency highlighted Ncell’s strong financial profile, steady profitability, experienced management, etc. as key drivers for reaffirming the “A” ratings. It referenced the telco’s low gearing of 0.7 times and fair total debt (TD) to OPBDITA of 0.7 times as of mid-July, 2024. It further added that despite suffering revenue losses, the company’s profitability indicators remain firm with operating profit margins (OPM) of ~54% in FY 2024. ICRA noted these as positives for issing the company “A” ratings.

Despite the exit of Axiata Group, the augmentation of experienced directors and management team remains a positive for the company’s incremental business performance – ICRA Nepal

Also, the company has received losses from voice and international long-distance (ILD). But, it has implemented good cost control strategies which in turn has restricted higher correction in its margins. Despite the telecom company’s challenges, the private telco occupied a higher market share in data at 53% in FY 2023. It also boasts comparatively a higher ARPU in the industry.

ICRA also points out that despite the exit of Axiata Group from Ncell, its experienced directors/management “remains positive for the company’s incremental business performance.”

The rating agency also claims that the exit of Axiata will have less effect on its ratings as the telco is likely to retain the same consistent financial profile in the future.

The “A” rating reinforces Ncell’s positive market outlook despite the whole industry witnessing challenges. More positively, ICRA Nepal declares positivity for the telco after Axiata’s exit.