Recently, Apple introduced a new feature for its iPhone users called Apple Pay Later which allows users to take loans and split payments into installments. Built into the wallet, the feature is currently available to users in the US however, could expand to more markets soon. So, in this post, we have listed eligibility criteria and steps to unlock this service.

Let’s first learn more about the feature.

What is Apple Pay Later service?

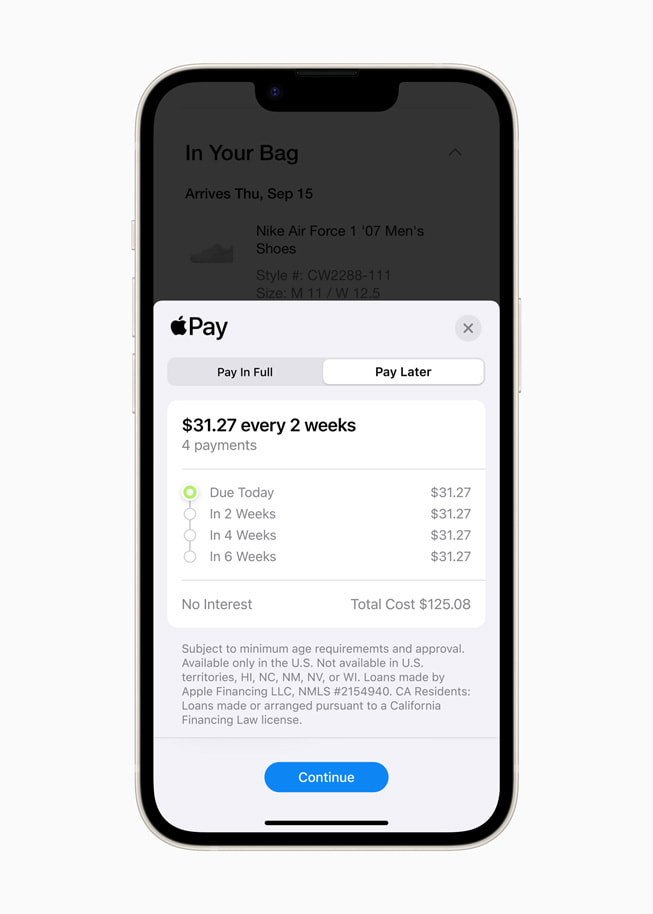

Apple Pay Later is a loan-based payment service for iPhone and iPad users. It is designed with users’ feasibility for payment. It lets users split the bill into four separate payments over six weeks without interest and service charges. With it, iPhone users apply for loans from $50 to up to $1,000.

Don’t miss: iOS 16.4 Launched With Voice Isolation That Greatly Improves Call Quality

Where can it be used?

The Apple Pay Later feature can be used on iPhone and iPad devices for online and in-app purchases with merchants who accept Apple Pay payments. It is activated with MasterCard Installments.

The US phone maker has started inviting users to use the beta version of the service. The full version will roll out in the next few months.

Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet said, “There’s no one-size-fits-all approach when it comes to how people manage their finances. Many people are looking for flexible payment options, which is why we’re excited to provide our users with Apple Pay Later”. She added that the feature makes it easier for buyers to make “informed and responsible borrowing decisions”.

Also read: iPhone 14 Pro & iPhone 14 Pro Max Once Again Receive Price Drop in Nepal

Financially healthy users can use the Buy Now Pay Later service of Apple

To start using Apple Pay Later, iPhone users first must apply for a loan in their wallet. After this, users need to enter the amount to borrow and agree to the terms. It is ensured that the user is in a healthy financial position to proceed with the loan.

When the user is approved, the Pay Later option becomes visible after selecting Apple Pay which enables online payment online and in apps on iPhone and iPad. After the setup, Users can apply for a loan directly after making a purchase.

Once the feature is set up, users can also apply for a loan directly in the checkout flow when making a purchase. As it’s integrated into the wallet, users can easily see the due amount in their loans, and the total due in the next 30 days.

Check out: Apple iPhone Price in Nepal | Latest Update 2023

How to set up Apple Pay Later on iPhone?

To set up Apple Pay Later on your iPhone, first, you need to add it to your Apple Wallet. Then you need to follow the steps below:

- Open the Wallet app on your iPhone.

- Tap Add.

- Set up Apple Pay Later. Now, tap Continue.

- Follow the instructions and apply for an Apple Pay Later loan enter the value of the purchase you want to make when requested to enter your desired amount.

- Tap Next and verify your detail including name, date of birth, and address.

- Review your personal details and tap Agree & Apply.

- Review your payment plan and agreement details.

- Add to Wallet.

A top-notch security

If you had concerns, don’t worry. The service has been built with privacy and security at its core, says Apple. Purchases are validated with Face ID, Touch ID, or passcode. Likewise, transaction and loan history is never shared with third parties.

Apple Pay Later is available to users in the US for now in a prerelease form. However, more users will receive the roll out in the coming months.

For more on the feature, do leave your query in the comments below.