Four of Nepal’s top digital wallets have struck up their partnership for a KYC campaign. eSewa, Khalti, IME Pay, and Prabhu Pay have initiated KYC is Necessary “KYC Jaruri Chha” to bring seamless digital payment and financial services to the people and promote the country’s digital transformation.

KYC which stands for Know Your Customer is a basic part of customer registration for many services including banking, and digital wallets. The Nepal Rastra Bank (NRB) has necessitated KYC for user verification for mobile wallet services. Therefore, the campaign plays a significant role in spreading the importance of KYC verification among users.

Besides authenticating users, KYC is also helpful to curb money laundering, online scams, illegal crypto mining, online betting, and other cybercrimes.

When you sign up with a digital wallet, you are asked to register your KYC. Without it, your mobile banking transaction limit gets narrow. So, for both use cases and security reasons, KYC submission is a must from a user’s perspective.

Also, NRB has made it a law that from fiscal year FY 2081/82, all digital users must mandatorily update their KYC. So, this “No KYC No payment” initiative will start from Shrawan 1, 2081.

You shouldn’t miss: Know the life cycle of an Ntc SIM card and when it terminates

Users with unverified KYC will have their digital wallet accounts frozen

It’s said that users who haven’t updated their KYC will have their digital wallet services unfunctional and money will be frozen from Shrawan 01, FY 2081/82. However, the accounts will resume to full functions after a KYC verification. This regulation makes it imperative to update KYC. There are over 20 million (2 crore) digital wallet users in Nepal.

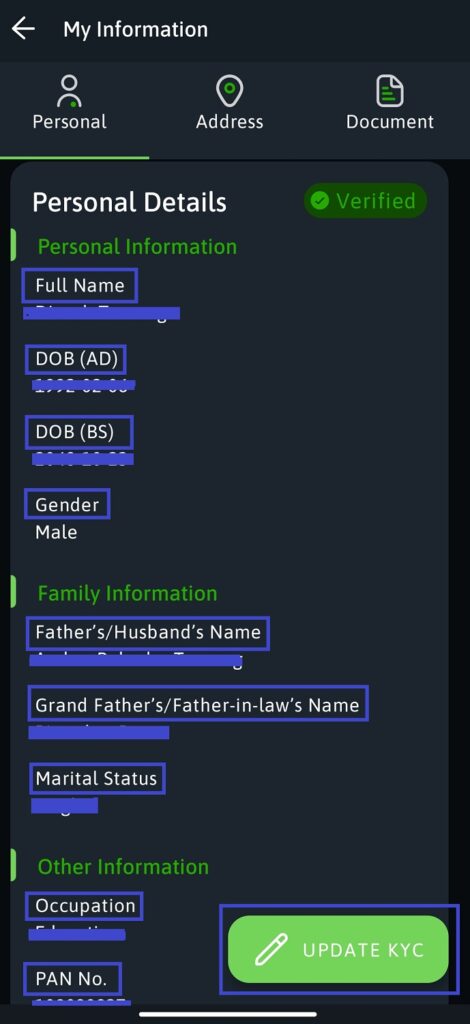

A KYC update basically requires the user’s vital personal data to be submitted to the service provider. The details include name, date of birth, a digital citizenship copy, etc. If you are using a digital wallet, then you will need to provide these details to the company in an electronic form which is available through the app itself. To better illustrate, here’s a sample of an eSewa KYC form.

Check out: eSewa launches cross-border payment for Indian citizens to pay in Nepal

Companies pledge their compliance with NRB for KYC

Speaking about this partnership for the digital transformation of Nepal, Jagdish Khadka, Chief Executive Officer of Nepal’s first payment service company eSewa Limited, says, “It is a very important step to provide more convenience to eSewa users by simplifying digital payment services. KYC authentication is extremely crucial to protect users from digital scams as well as prevent misuse of digital wallets for illegal activities.”

Likewise, Binay Khadka, chief executive officer (CEO) of Khalti Payment Service, says, “The Khalti digital wallet, which has been working for the past 7 years for the financial inclusion of all Nepalese, allows payment from the digital wallet app according to the guidelines of Nepal Rastra Bank,” he adds, “I am confident that this collaboration of leading digital wallets will prove to be a stepping stone for the financial participation of all Nepalis as it is mandatory. Also, I have expected cooperation from all the regulatory bodies including Nepal Rastra Bank in this collaboration.”

Pravin Regmi, IME Pay CEO stressed the importance of KYC for easy and secure payments, “KYC authentication is the first step towards transparent financial transactions and corruption.”

Similarly, Bikki Shahi, CEO of Prabhu Pay, says that KYC plays an important role in facilitating cashless transactions and protecting customers from online fraud as well as preventing criminal activities, knowingly or unknowingly.

Have you updated your KYC for your digital wallet account? If not, then maybe it’s time you did that or face some regulatory scrutiny. For any help, suggestions, or queries, do let us know in the comments below.