Fonepay announced on April 22, 2024, the launch of a revolutionary Fonepay Credit Card, a virtual credit card scheme by Citizens Bank International Ltd. With this, the leading commercial bank has become the first banking institution in the country to launch such a service to its customers. Fonepay, Nepal’s largest digital payment network says that the much eagerly anticipated service is now technically and operationally ready for the customers.

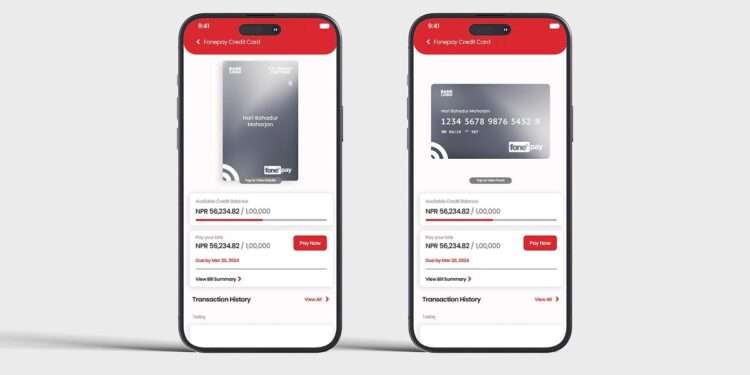

Fonepay believes that the virtual credit card service will set a benchmark in the industry and redefine the customer experience. The Fonepay Credit Card is a Digital Card that you can conveniently avail of and transact from their mobile banking application.

Also read: NRB increases the limit of digital payment in Nepal

What is the Fonepay Credit Card?

Fonepay Credit Card is a virtual credit card launched by Citizens Bank in collaboration with Fonepay. The digital credit card service allows the bank’s customers to perform various eligible financial transactions on their smartphones using the bank’s mobile banking app. That means the service rids you of having to carry a physical credit card in your pocket. So, if you have a habit of forgetting your credit card or losing or dropping it around places, this virtual credit card scheme is revolutionary and highly effective for you.

In other words, it’s a digital card solution that empowers credit card subscribers with convenience and flexibility not experienced before. Additionally, it lets you keep complete control over your credit card functionality.

Fonepay Credit Card is an innovative virutal credit card service in Nepal, a result of a collaboration between Fonepay and Citizens Bank

How is this useful?

Well, apart from it being useful being virtual, there are other obvious advantages to keeping it. First, it enables an exhaustive range of digital transactions across the Fonepay network. Firstly, the fact that Fonepay boasts an overreaching digital payment network in Nepal, the convenience is unmatchable. Secondly, it lets customers perform QR payments, online or eCommerce platform payments. Add to that, it unlocks highly convenient features such as seamless EMI conversion.

Essentially, customers get seamless onboarding for the Fonepay Credit Card service, and the delivery of the cards is complete within a few seconds. It’s found on the mobile banking app. With this innovative service, you can enjoy new and advanced features of the Fonepay card achieving full control over card management, limit control, and statement delivery among others. This basically transforms the credit card experience from other traditional payment methods.

Check out: eSewa launches cross-border payment enabling Indian citizens to pay in Nepal: Find steps

Good for the merchants and the national economy

“We are excited to introduce the Fonepay Credit Card Scheme as the latest addition to our suite of digital payment solutions,” said Diwas Kumar, CEO of Fonepay. Our mission has always been to prioritize customers and this new product embodies that commitment. With the aim of democratizing credit, we’re ensuring that credit access is within reach of all. For merchants, this means a boost in business and a cost-effective solution. Since this is a domestic scheme, we will also be saving millions for the economy as we lead the charge towards a more inclusive and prosperous financial future for all Nepalese.”

Kumar concluded, “Fonepay extends its gratitude and congratulations to Citizens Bank for placing their trust in our solution. And also, for being the FIRST bank in Nepal to introduce Nepal’s own Virtual Card Scheme.”

If you want to know more about the Fonepay Credit Card scheme, do let us know in the queries below.