Nepal Digital payment company (NDPC) has updated the Namaste Pay app in the Google play store on Jan 21, 22 (Magh 7, 2078). With the new update, the app has become stable and enables you to smoothly load funds to Namaste Pay from more than 40+ Banks and Financial Institutions. Additionally, you will be able to transfer money via Connect IPS, mobile banking, internet banking too.

The beta launch debacle forced the company to upload a new Namaste Pay app in the Google play store on Ashoj 13, 2078. Earlier the digital payment service was launched on September 14, 2021 (Bhadra 29, 2078). One of the great features of the Digital payment mobile money service is the ability to perform offline transfers, payments that is, without the use of the internet. You can also make online payments using a mobile app.

It seems like the app crash problems and issue in loading money to the wallet have been resolved. We had expected the web login feature this time but it is also not available on Namaste Pay’s website at the moment.

Before Namaste Pay was launched via an official program at Soaltee Hotel. The launch program had a gracious presence of MoIC Secretary and NT Chairman Mr. Baikuntha Aryal, Rastriya Banijya Bank’s Chairman Mr. Ram Sharan Pudhasaini, NTA Chairman Mr. Purushottam Khanal, NDPC’s board members, NTC & RBB’s Senior officials. Namaste Pay’s logo, its android app, and shortcode for USSD service were unveiled at the event.

Namaste Pay is the mobile money service set up by Nepal Telecom and Rastriya Banijya Bank (RBB) with an authorized capital of Rs. 1 billion. This government-run digital payment app has become the mobile wallet with the largest paid-up capital of Rs. 400 million.

Namaste Pay: both an online and offline mobile wallet

Namaste Pay is not only the first government-run payment service provider (PSP), but also, the first offline mobile wallet. It means the user need not have an internet connection to make digital payments.

Up until now, there were only online digital payment platforms for the users to make transactions. It required smartphones and an internet connection. With the use of Namaste Pay, NT users with feature phones (non-smartphones) can also make offline transactions anytime and anyplace.

The payment system will use the mobile number as a digital wallet. The ability to use mobile balance funds to pay bills like electricity bills, water bills, etc, will not come now due to the regulations’ restrictions.

So there will be two separate accounts for the mobile number, one for Mobile balance and another for Namaste pay wallet. This feature helps to skip the taxes included in the service charges. Such an option makes mobile money service cheaper and easier.

Check out: Nepal Telecom launches VoLTE Service

For payment, the company also uses the USSD channel which has a fast response. Then, by typing the USSD code, the users can make offline transactions. This option is much more secure than SMS too. It will also help non-smartphone users and digitally illiterate people to access such payments.

For online users, a mobile wallet app will be available. Rashtriya Banijya Bank will act as a settlement bank for payment services. As per the info, all mobile numbers in Nepal can do the payment from Namastepay using both online and offline means.

Largest paid-up capital of Rs. 400 million

The Nepal Digital Payment Company is so far the largest in terms of paid-up capital. Among the 27 PSPs approved by Nepal Rastra Bank (NRB), Namaste Pay has the largest paid-up capital.

According to the Nepal Telecommunications Authority (NTA) provision, the digital payment companies should make a paid-up capital of at least Rs. 10 million. As per the details released by Nepal Rastra Bank, the paid-up capital of Namaste Pay is Rs. 400 million.

After Namaste Pay, the companies with the highest paid-up capital are IME Pay and Prabhu Pay. Their paid-up capital is Rs 100 million. Similarly, eSewa has a paid-up capital of Rs. 50 million.

Check out: Top Digital Wallets in Nepal

How to register your mobile number for Namaste Pay?

To register for Namaste pay online, you need to download the mobile app and register thereby filling in KYC details. That also requires your information and Identification scanned photo. Where in the case of offline using featured phones, you can do it as below.

Here is the process to register your mobile number for the digital payment service offline.

- Dial *500#, Press 1 to go further.

- Enter First name, Last name, Date of birth, Gender, ID type, and ID number.

- Confirm the entered data.

- You will get a PIN code that you will need to access the payment service.

- Once you enter again from *500#, you will be asked to change the PIN code of your own.

For now, only Nepal Telecom users can use this Namaste pay service while they will enable the service for Ncell and Smart Cell users too.

How to use Namaste Pay service?

You can use the Namaste pay service online via an app and offline through USSD code. Once you are registered for the service, you can also access it either way. All you need is the PIN code.

To access the payment service online, you need to

- Download and Install the new Mobile app from the Google play store. The iOS app will be available a little later.

- Enter your number and PIN code.

- For this first time, you may need to enter the OTP.

- Then you will log in to the Namaste pay app.

- Find different payment services within the app.

- If you had registered in the app before, you just need to enter the PIN code with your number.

- If you have changed your device, then it will send you an OTP code to verify your identification.

To access the payment service offline, you need to

- Dial *500# and Enter the PIN code.

- Then you can get info on your account, transfer money, recharge, or load balance from the menu itself.

- You can transfer to another Namaste pay wallet or unregistered numbers or even request money.

How to load funds on Namaste Pay wallet?

To load funds/money on Namaste Pay wallet, you need to follow the steps as

- Go to the Add money section on Namaste Pay app.

- Enter the amount you want to load and click next.

- Select the already integrated bank account or via other Mobile banking or e-banking or Connect IPS and click add money.

- Then you will be asked for your PIN number (your Namaste Pay login)

- The loading is easy for the integrated bank. For others, you will be promoted to enter mobile banking or e-banking or Connect IPS login there.

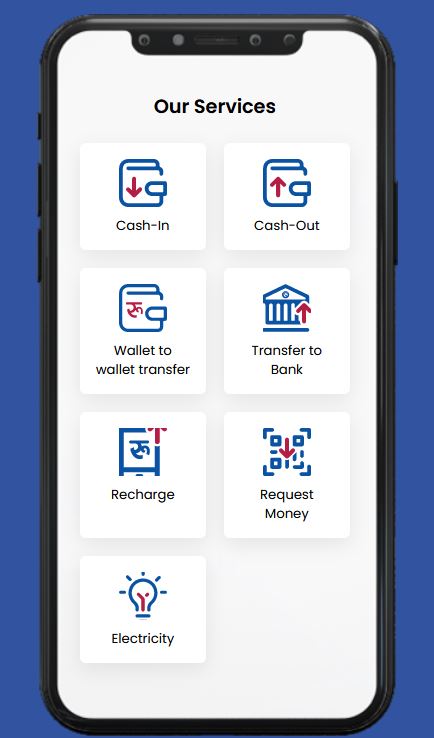

Namaste Pay Features

For now, Namaste Pay’s digital payment platform has limited features, as with all wallets have in the earlier phase. However, Nepal Digital Payment Company is known to add more features with time.

- Android app for mobile wallet

- USSD code (*500#) for Offline payment

- Mobile recharge and bill payment

- Internet service payment

- Electricity bill payment

- Khanepani (Water) bill payment

- 40 plus banks integrated to load balance in Namaste pay

- Request money via dynamic QR

- QR code-based payments

- Fund transfer to bank accounts

- Payment from Web login

The first beta launch had many issues including the app crash mostly for Android 11 phones. Similarly, the money loading in the wallet had many issues. But it seems like the crash issue and load balance issue have been solved.

A perfect mobile financial service needs the integration, development, and testing with Banks, merchants, utility service providers, online business operators, interconnection partners, and other stakeholders. Nepal Digital Payment company says that the process is challenging and time-consuming to operate all kinds of services at once, also to identify and solve the problems that may arise in the initial stage. Therefore, the company has adopted a strategy of gradually adding and diversifying its services, starting with the minimum number of services.

The company expresses its commitment to making the Namaste Pay service more customer-oriented and useful by adding more services, facilities for greater financial inclusion. They also commit to making the financial service more secure than just making a profit out of it. NDPC seeks constructive suggestions and advice from well-wishers in strengthening their position in the digital payment landscape.

Have you used the Namaste Pay service lately? Do you have any suggestions for the service, share your thoughts in the comment section below.